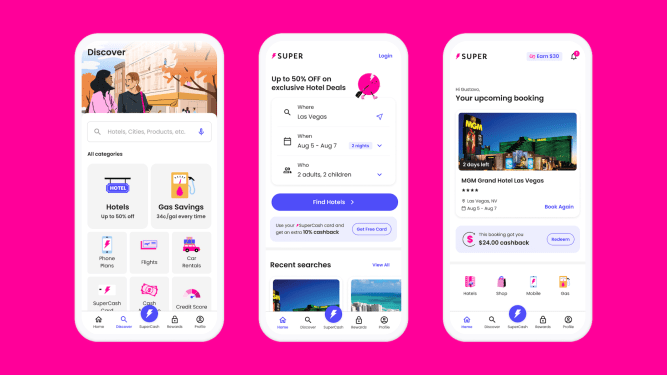

In today’s inflationary environment, cutting costs and saving money has become a top priority for many individuals. With the increasing demand for innovative solutions to manage expenses, Super.com, formerly known as Snapcommerce, has launched its cashback card SuperCash in October last year. This move has enabled the company’s 5 million customers worldwide to collectively save over $150 million to date, according to CEO Hussein Fazal. Now, Super.com is expanding its horizons by introducing a super app that will help ‘everyday Americans’ find deals and savings across multiple categories.

A Breakthrough in the Super App Era

Super.com’s CEO, Hussein Fazal, emphasized that the company is part of an elite group, including PayPal, Uber, and DoorDash, which are all compiling more and more features under one app. However, Fazal stated that his company is modeled after WeChat by breaking into verticals like travel and fintech. This strategy has enabled WeChat to grow its user base into the billions.

"We’re not just another super app," Fazal said in an interview with TechCrunch. "Unlike other super apps, we are trying to have a theme that customers can gravitate toward, and we think savings is that theme."

Innovative Approach to Savings

Super.com’s focus on savings is a game-changer in the market. The company is not just limited to providing cashback rewards; it aims to be the go-to platform for all savings-related needs. Fazal explained that Super.com is launching its super app because of the great cross-sell rate of people coming in to buy one product and ending up buying another.

"We’re seeing a lot of customers come in to buy one product, and then they end up buying another," Fazal said. "That won’t always be the case, so we want to make sure that we’re building an app that will continue to grow with our users."

New Investment of $85 Million

To further accelerate its growth, Super.com has secured a new investment of $85 million, which includes $60 million in equity and $25 million in a credit facility. This brings the company’s total funding to nearly $200 million.

Inovia Capital led the round and was joined by new investors, including Shopify president Harley Finkelstein; Ancestry.com CEO Deb Liu; Allen Shim, former CFO of Slack; Golden State Warriors CFO Josh Proctor; Substack CEO Chris Best; Confluent CTO Neha Narkhede; Mike Lee, co-founder of MyFitnessPal; Hyphen Capital; EDC and Plaza Ventures. Existing investors, including Telstra Ventures, Acrew, Lion Capital and NBA superstar Steph Curry, also participated.

Raising Funds in a Challenging Environment

Fazal last raised funding in 2021 when the company was still in its early stages. At that time, he noted that raising funds was not as challenging as it is today. However, Super.com’s innovative approach to savings and its focus on building a super app have made it an attractive investment opportunity.

"We’re not just raising money; we’re raising capital for our vision," Fazal said. "We believe in the power of savings, and we want to make sure that everyone has access to the best deals and rewards."

The Future of Savings

Super.com’s super app is poised to revolutionize the way people save money. With its innovative approach to savings and its focus on building a comprehensive platform, Super.com is set to become a leader in the industry.

As Fazal said, "We’re not just another super app; we’re the future of savings."

Related News

- Hyperline secures $10 million for its automated billing platform

- Chinese AI company MiniMax releases new models it claims are competitive with the industry’s best

- Reusable rocket startup Stoke raised another massive round: $260M