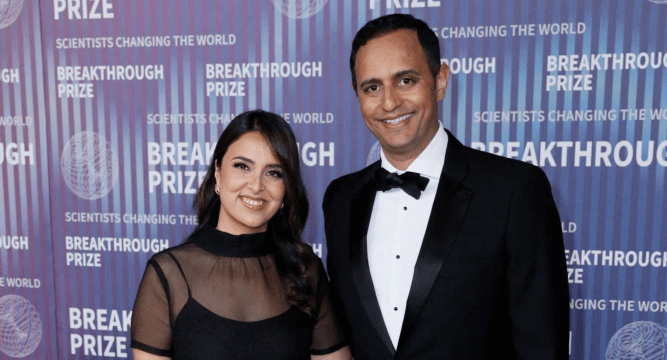

Neil Mehta, the venture capitalist behind a string of high-profile acquisitions on San Francisco’s prestigious Fillmore Street, has been making waves in recent weeks with his plans to revamp the area into a vibrant hub of luxury retail and dining. But what drives this ambitious entrepreneur, and can his vision bring new life to one of the city’s most iconic neighborhoods?

The Acquisition Strategy

Mehta’s approach to revitalizing Fillmore Street is multifaceted. He has acquired several key properties along the street, including a historic theater and adjacent retail building for $11 million – nearly triple what their previous owner paid in 2008. This savvy move demonstrates Mehta’s willingness to invest heavily in his vision, even if it means paying a premium for each property.

Leasing at Below-Market Rates

To minimize turnover and create a cohesive shopping experience, Mehta is leasing out the properties to tenants at below-market rates. This strategy not only reduces his risk but also incentivizes long-term occupancy, allowing businesses to establish themselves in the area. By creating a diverse mix of high-end retailers and dining establishments, Mehta aims to attract a loyal customer base that will drive foot traffic and increase property values.

The Benefits of Density

CBRE’s Alex Sagues explains that shopping districts succeed when carefully mapped out to avoid cannibalization. "You don’t want two coffee shops side by side," he notes. However, strategically placing complementary businesses can create a draw for customers seeking a specific experience. This approach is evident in Mehta’s vision for Fillmore Street, where high-end food establishments will cater to discerning palates while luxury retailers offer exclusive products.

Market Impact

Mehta’s plans may already be impacting the market. According to Redfin, home values in Pacific Heights – one of San Francisco’s most expensive neighborhoods – dipped during the pandemic but are now rising quickly again, reaching $2.25 million in July, a 28.6% year-over-year increase. This surge suggests that Mehta’s revitalization efforts may be contributing to increased demand and property values in the area.

A Visionary’s Approach

Mehta’s approach to revitalizing Fillmore Street is a testament to his entrepreneurial spirit and willingness to take calculated risks. By investing heavily in properties, leasing at below-market rates, and creating a diverse mix of businesses, he aims to create a vibrant destination that will attract customers from across the city.

The Future of San Francisco

As Mehta’s vision for Fillmore Street continues to unfold, it remains to be seen whether his approach will serve as a model for other neighborhoods in need of revitalization. However, one thing is clear: Neil Mehta’s commitment to transforming this iconic street into a hub of luxury retail and dining has the potential to leave a lasting impact on San Francisco’s economic landscape.

Related Stories

- The Rise of Luxury Retail: As consumers increasingly prioritize experiences over material possessions, high-end retailers are shifting their focus from brick-and-mortar stores to creating immersive brand environments.

- Revitalizing Urban Spaces: Cities around the world are turning to innovative strategies to revitalize underutilized areas, from public art installations to co-working spaces and trendy restaurants.

- The Impact of Venture Capital on Local Economies: As venture capital continues to flow into urban economies, it’s essential to examine the long-term effects of these investments on local communities and businesses.